What is a DARWIN?

A DARWIN is an investment product uncorrelated to other financial assets since traders trade both long and short interchangeably. What is more, it combines a trading strategy managed by a trader with Darwinex’s independent Risk Management Engine.

Investing in DARWINs is not available for Darwinex Global (FSA regulated) clients.

Darwinex transforms traders' trading strategies into a new product, a "DARWIN".

The DARWIN replicates the trader's strategy, entering the markets when the trader places an order but with the risk managed by Darwinex's Risk Engine.

Every DARWIN asset trades within the same range of target risk: 3.25-6.5% monthly VaR.

Replication

The DARWIN automatically replicates trades opened/closed by the trader.

However, this process takes place without revealing the trade details so as to protect the intellectual property of our traders.

DARWIN vs. strategy

Our own Risk Engine is the tool used at Darwinex to ensure that all the DARWINs are listed with the same level of risk.

The Risk Engine determines the size of the trades the DARWIN will open for its investors in the assets traded by the trader.

By these means, the DARWIN replicates the trader's strategy and Darwinex establishes the target risk level which oscillates in between 6.5% and 3.25% monthly VaR.

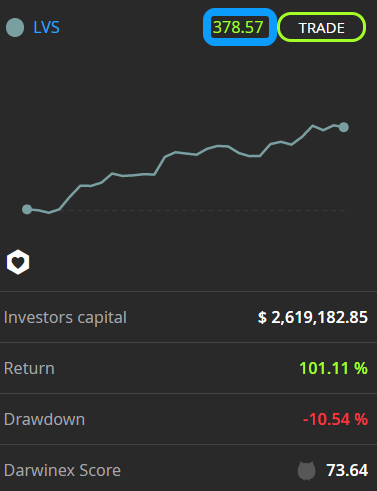

DARWIN quote

The DARWIN quote is based on the DARWIN's return since its inception.

All DARWINs start at 100 and this quote rises or falls according to the return obtained since their "birth".

A quote of 378.57 means that the DARWIN has obtained a return of 278.57% since inception (378.57 - 100 = 278.57%).

Thus the DARWIN quote shows the return an investor would have obtained in theory if they had invested in the DARWIN from the very beginning.

The quote is calculated by taking into account both open and closed trades, as well as the execution costs.

The quote updates every 30 seconds.

We recommend that you also read:

Related podcasts

- On how traders at Darwinex can have their own hedge fund without the legal burden of creating one.

- “This strategy / hedge fund is low risk because it has a low drawdown”. Do you agree with that statement? If you do, watch The Deer Hunter and listen to this podcast episode.