How to manage DARWIN capacity

The Capacity Manager enables DARWIN providers to specify the conditions under which to close / reopen investments in their DARWIN.

Why it's necessary to manage DARWIN capacity

Since market liquidity is finite, if a DARWIN starts to manage a higher volume of capital, the price traded in the market could worsen due to a lack of liquidity to fill the whole aggregated volume from investors at the price the order is sent.

The higher the investment volume, the higher the likelihood of the divergence per volume to deteriorate.

However, traders can always adapt to the new volume invested in their DARWINs and close the DARWIN to new investment capital in order to protect current investors.

Additionally, a trader can use various techniques to improve their capacity and therefore reduce the divergence, for example:

- Split trades into smaller ones every couple of seconds approx.

- Avoid trading during low liquidity market conditions (FOREX between 17:00-18:00 NYT, indices between 18:00-01:00 NYT), high volatility events such as news releases, or during high tick volatility.

- Trade with a higher range of pips in both winning a losing trades.

What is the Capacity Manager

The Capacity Manager enables DARWIN providers to specify the conditions under which to close / reopen to new investment in their DARWIN.

Available setup options

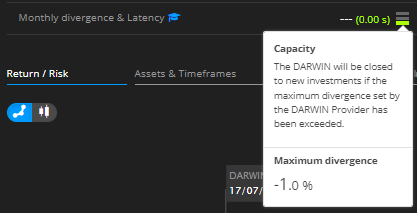

Maximum Divergence Accepted

- Closure: The DARWIN will automatically close to new investment capital if it exceeds the divergence threshold set by the trader. Darwinex will still cap maximum divergence permitted, at -1.0%. Therefore, the trader has the option to select a maximum divergence ranging between -1.0% and -0.3% with a 1 decimal granularity. The default value will be -1.0%.

EXCEPTION: Should a DARWIN have less than $ 10,000 invested, reaching the maximum divergence will not close it to new investment.

Maximum Investor Capital (optional)

- Closure: If the DARWIN exceeds the capital under management threshold set by its provider, it will close to new investor capital. Traders can set the maximum amount (USD) that they want to manage with the DARWIN. The value must be greater than $500,000 and in multiples of 100,000. This condition will not be taken into account if the field remains empty, which is the default option.

DARWINs will remain closed to new investor capital under any of the criteria mentioned, which would equal a used capacity of 100%, and will reopen when the used capacity decreases below 95% again.

How to set it up

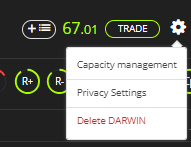

In order to manage a DARWIN’s Capacity, traders will have to go to its main profile and click on the cogwheel icon located next to the “TRADE” button, as circled in yellow in the image below:

Once there, they will need to click on the “capacity management” section where the two options explained above will be displayed (maximum divergence / maximum investor capital).

What happens when a DARWIN is closed to new investors?

Once the DARWIN is automatically closed to new investor capital, both investors – including those with a conditional order – and DARWIN providers, will receive a notification.

In addition, the “TRADE” button will be replaced by “SELL” and conditional orders will not be allowed.

Should a limit order previously placed get triggered, it will be discarded and a notification will be sent to the investor concerned.

Capacity Traffic Lights

The Capacity Manager comes together with a traffic light equipped with three horizontal lines to enhance the understanding of the current state of the DARWIN’s Capacity.

Like a conventional traffic light, it will come with the following range of colours:

- 1 green line: the DARWIN is still far from reaching the Capacity limit set by its provider.

- 2 yellow lines: the DARWIN is close to reaching the Capacity cap set by the trader.

- 3 red lines: the DARWIN has already reached its Capacity limit, and is closed to new investments.

You can hover the mouse over the traffic lights to learn more.