What does the DARWIN's quote mean?

The DARWIN's quote is determined by the return of the DARWIN since its inception. All DARWINs start with a quote of 100.

Introduction

A DARWIN is a special financial product which quote is not determined by the supply and demand of the market, but by the return obtained when replicating the trades from an underlying strategy.

Additionally, the volume of a trade in a DARWIN is not decided by the underlying trading strategy, but by the Risk Engine designed by Darwinex.

The quote of a DARWIN can be seen...

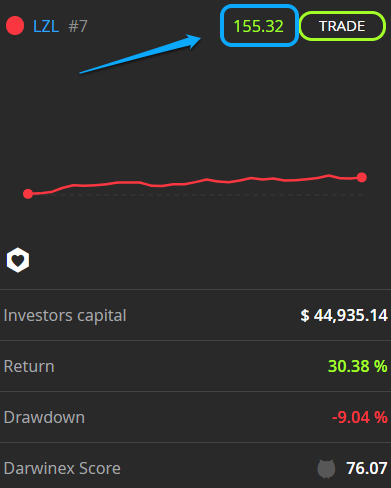

1. On its profile

Every DARWIN is listed with a base of 100.

This means that, at birth, all DARWINs will quote at 100.

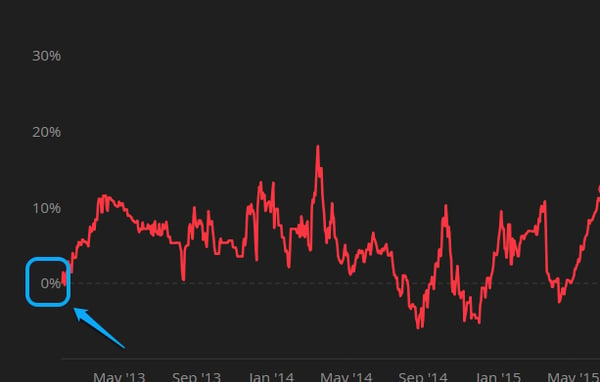

2. On its return curve

This curve reflects the return in terms of a percentage.

This means that all DARWINs are listed starting at 0% (quote value = 100)

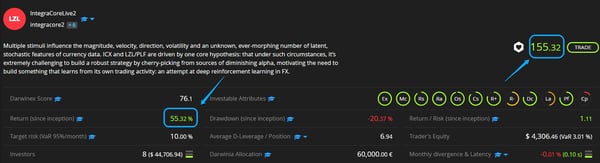

Case study

Let's look at the quote progress over time.

Initial value

All DARWINs start with a quote of 100 and a return of 0%.

Replication

As the underlying strategy carries out trades, the DARWIN will replicate all of them with a position size determined by Darwinex's Risk Engine.

The result of replicating these trades provides a return that will add to, or subtract from, the value of the DARWIN's initial quote and its return.

Value's progress

The percentage results for each month can be seen just below the DARWIN's return chart, in the ''Return/Risk'' tab.

Chart

We can also see the return curve of any DARWIN on its return chart.

- If there are open trades on the underlying strategy, the DARWIN quote will update every 30 seconds.

- The price shows what an investor would have theoretically obtained if they had invested in the same currency as the underlying strategy (EUR, USD or GBP), with an initial value of 100, and with an identical execution between the DARWIN and the investor = 0% divergence.

- The value and the return of a DARWIN are calculated based on the opened and closed trades up to that precise moment, taking into account commissions, spreads, and swaps.

Do you want to learn more?

If you want to learn more about DARWINs, and the main differences between them and their underlying trading strategy, we encourage you to watch the following webinar hosted by by Juan Colón: