Return calculation at Darwinex

Although the concept of return is fairly intuitive for most people, the way it is calculated and analyzed can be a bit more complex, which can lead to erroneous conclusions.

What is it?

Return refers to the financial result associated with an investment decision.

How is it calculated?

Darwinex calculates the return for a position or timeframe as a percentage of the equity used for a given position or at the start of a given timeframe.

The following information is taken into account:

- Closed trades / realized profit or losses

- Open trades / unrealized profit or losses

- Deposits & withdrawals* of money from the account. This is done so the percentage return is reflected correctly.

*By calculating return based on equity, deposits and withdrawals do not affect the percentage return. This is done so that a trader can't artificially skew his results by depositing or withdrawing money.

Example

1- A trader with €1,000 in his account opens a trade that is generating a profit of €50 (5%).

2- Before closing the position he decides to withdraw €950.

3- Seconds later, he closes the trade.

Darwinex splits this trade into 2 positions with the following result:

Position 1 (finishes before the withdrawal of €950):

- Initial Equity => €1,000

- Final Equity => €1,050

- Return => 5%

Position 2 (starts after the withdrawal of €950 and finishes with the trade being closed):

- Initial equity => 100 €

- Final equity => 100 €

- Return => 0%

- Compound return of both positions => 5%

Where can I see it?

In Darwinex it is important to distinguish the DARWIN return from that of the underlying strategy.

- DARWIN

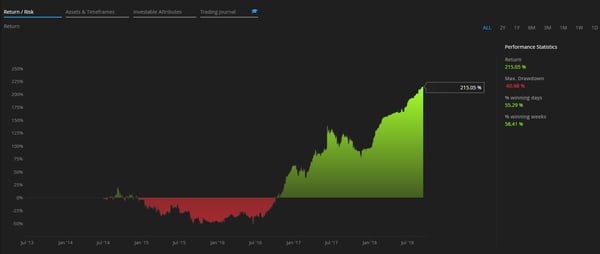

On the DARWIN profile page, you can see the return chart for one of the pre-set timeframes offered by Darwinex (TOTAL, 2A, 1A, 6M, 3M, 1M, 1W y 1D).

By left-clicking and dragging on the mouse, you can zoom in on a specific period to see the % return for a custom time period.

Right below, there is a table showing returns per month, year and since the inception.

- Underlying strategy

As with the DARWIN, you can see the equity return curve of an underlying strategy in addition to a summary table displaying monthly/yearly/total returns.

The return chart of the trading strategy does not permit zooming.

However, this can be done by switching to the Trading Journal.

Update frequency

- Return on both DARWINs and their underlying strategies is updated every 30 seconds.

- Return of live trading strategies without DARWIN and of demo trading strategies is updated once a day, during the European nighttime.

Tips

- It's not just about the return

Remember that there is more to a good strategy than just its return.

Past results are no guarantee of future returns and as such. Therefore, it is recommended that you understand the Investable Attributes of a DARWIN / strategy to determine whether a return has been achieved by skill or by luck.

- Return on summary tables is compounded and not summed

The total cumulative return does not match the sum of the monthly returns.

This is because the cumulative return over a period is calculated by compounding the returns of the constituent sub-periods, and not by simply adding them up, by using the following mathematical formula:

[1+(R1/100) * 1+(R2/100) * 1+(R3/100) * 1+(Rn/100) ... -1] * 100

*R = return in %