Tax Reports in IBKR

In this article, we'll explain how to download your annual tax report, as well as your activity statement and Form 1042-S in IBKR.

Content

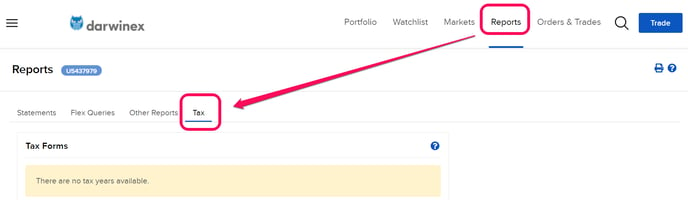

Annual Tax Report

Annual tax reports can be downloaded from the "Reports" tab, "tax" section, that you may find in your IBKR Client Portal.

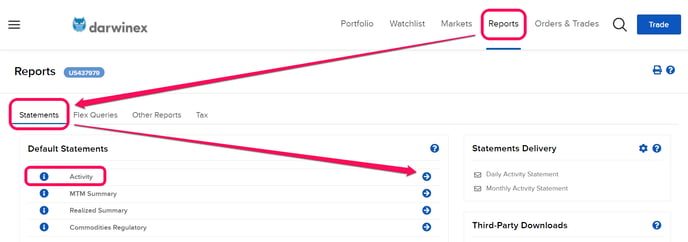

Activity Statement

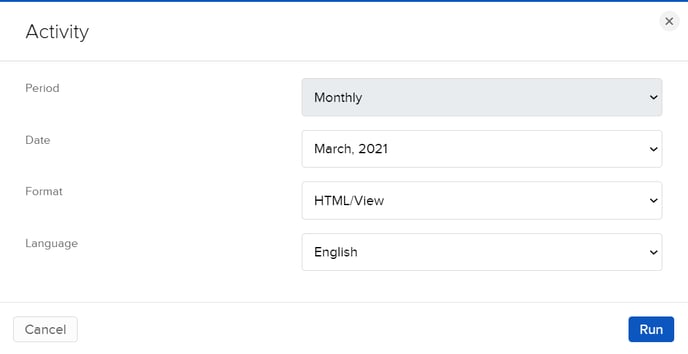

In addition to the annual fiscal report, IBKR clients can download both monthly and annual activity statements.

The activity statement will include multiple pieces of information, including the following:

- Account information

- Net Asset Value

- Mark-to-Market Performance Summary

- Realized & Unrealized Performance Summary

- Open Positions

- Dividends

- Interest

- Withholding Tax

- ...

To download the statement, you just have to click on the "Reports" tab and then select "Statement / Activity".

Form 1042-S

Form 1042-S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, etc.

Form 1042-S will be available to you by March 15th and you may find it in the same location as the Annual Tax Report.