Pending orders in DARWINs

Contrary to market orders, pending orders are are not immediately executed since the DARWIN quote needs to reach a certain value before the order is triggered.

What are pending orders?

Contrary to market orders, pending orders are are not immediately executed since the DARWIN quote needs to reach a certain value before the order is triggered.

At Darwinex, pending orders remain "pending" until the DARWIN reaches a certain quote previously selected by the investor, in which case the order will be executed automatically.

As a DARWIN investor, you can place four types of pending orders.

1. Buy Limit

A Buy Limit order will buy a DARWIN at a lower quote than the current one. This option is used by investors who want to make the most of a recent drawdown in a DARWIN in order to buy it at a ''cheaper'' quote.

2. Buy Stop

A Buy Stop order will buy a DARWIN at a higher quote than the current one. This order is used by investors who want to make the most of the current positive momentum of a specific DARWIN.

3. Take Profit

A Take Profit order will sell a DARWIN at a higher quote than the current one.

4. Stop Loss

A Stop Loss order will sell a DARWIN at a lower quote than the current one.

Where can you place pending orders in your DARWINs?

Pending orders can be placed only from our web platform since the mobile app "Darwinex for Investors" (Android and iOS) allows placing market orders only.

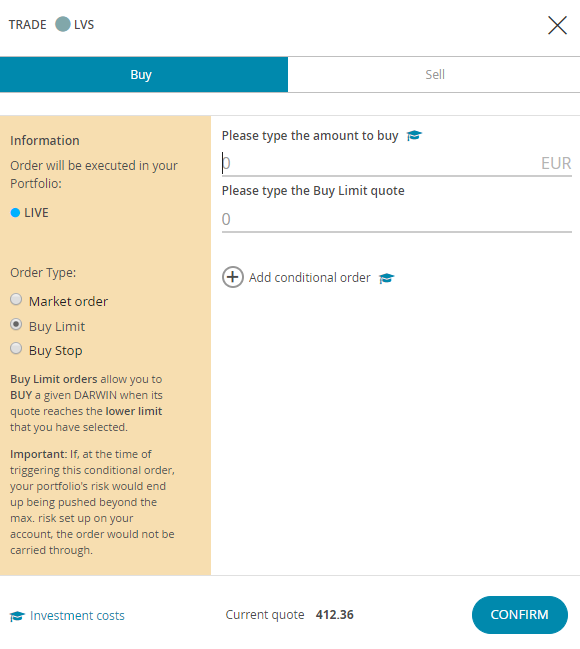

Place a Buy Limit or Buy Stop order

To set up a Buy Limit or Buy Stop order, you need to click on the ''Trade'' button of any DARWIN and:

- Choose Buy Limit or Buy Stop

- Enter Amount and Quote Price

- Confirm the order

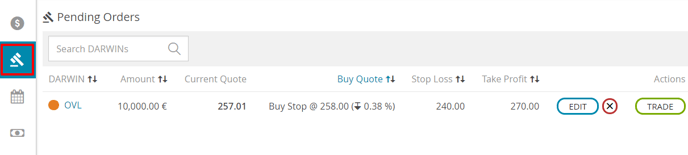

The pending order will appear in the "pending order" section inside the investment platform.

You can view, edit, or delete pending orders at your convenience.

Place Take Profit (TP) and Stop Loss (SL) orders

You can place TP and SL orders the moment you buy a DARWIN or once the purchase has already been made.

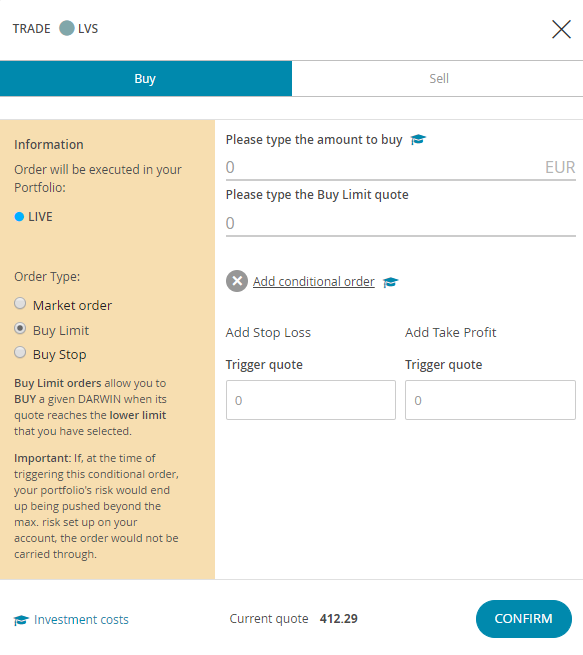

- When buying the DARWIN

If you want to place a SL or TP with a market order, a Buy Stop or a Buy Limit order, you just need to click on ''Add conditional order'', and then place the SL and/or TP order as shown below.

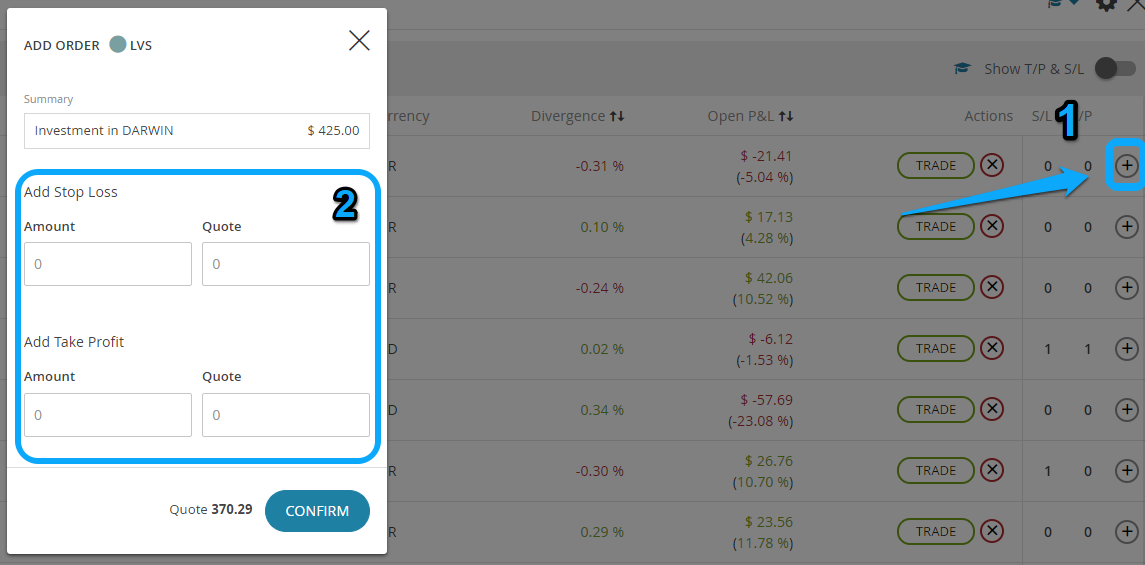

- Place and edit TP / SL orders on open investments

You can set up and/or edit a Stop Loss or Take Profit order on your open investments.

To do so, you just need to go to the "Investment" platform, click on the ''Invested DARWINs'' section, and then click on the ''+'' symbol at the very right of the invested DARWIN.

What happens when pending orders get triggered?

When pending orders get triggered, investors receive an email notification confirming whether the order was executed or not.

Buy limit and Buy stop orders don’t block money from your available equity, so if the order gets triggered and there’s not enough available equity to purchase it, the order won’t be executed.

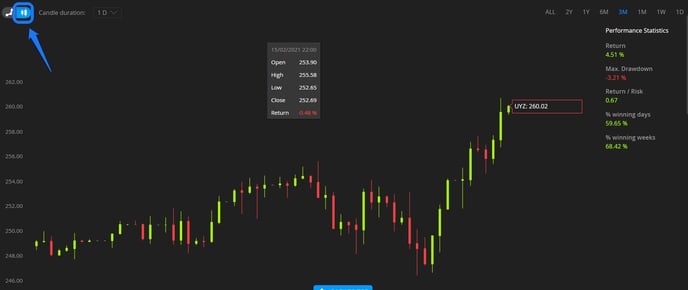

Candle charts to check whether the quote hit a certain level or not

In order to check whether a DARWIN quote hit a certain level or not, investors can consult our candle charts for DARWINs.

Limits in pending orders for DARWINs

There are a few limits when it comes to placing pending orders.

Investors won't be able to place more than:

- 20 pending orders per type and DARWIN (20x Stop Loss, 20x Buy Stop, 20x Buy Limit, 20x Take Profit)

- 200 pending orders per investment portfolio

Example

Even though our Risk Engine controls investors' leverage at all times, by setting up a Stop Loss an investor can avoid suffering losses greater than those they can bear.

DARWIN target risk set at 6.5% monthly VaR

A 6.5% monthly VaR implies that 1 out of every 20 months, the expected minimum equity loss would be 6.5% or MORE.

Therefore, placing a Stop Loss order can help you to avoid some ''statistically unexpected surprises''.

Tips

- Don't set Stop Losses too tight. If you decide to place a tight Stop Losses, you might run the risk of the SL being triggered by the slightest movement of a DARWIN against you, only to have the DARWIN return to its previous position.

- Plan ahead when to enter and exit the market. The use of pending orders means that investors don't have to check the DARWIN quote all the time. They are not only useful for reducing the risk but they can also be used to buy a DARWIN at a "cheaper" quote than its current one or to take profit (TP) once a certain objective has been reached.

Do you want to learn more?

If you want to learn more about conditional orders, we recommend watching the following webinar recording.