High Water-Mark on DarwinIA allocations

HWM treatment for DarwinIA allocations includes a reset

In order to maximize the performance fees to be received from DarwinIA assignments, the treatment of the HWM for DarwinIA allocations works in a different way. If your current allocations expire with losses, to avoid having to recover from those losses to exceed your HWM, this loss would be filled, so that any future assignments would start at the same level as your last high water-mark.

This way, you don't have to worry about your HWM in case you receive allocations again, as any profit made on future allocations will guarantee you performance fees. Please note that all your current allocations have to expire for this reset to occur, i.e. it will not take place as long as there are active allocations.

This article refers specifically to DarwinIA allocations treatment. For investors allocation please visit this article.

Example

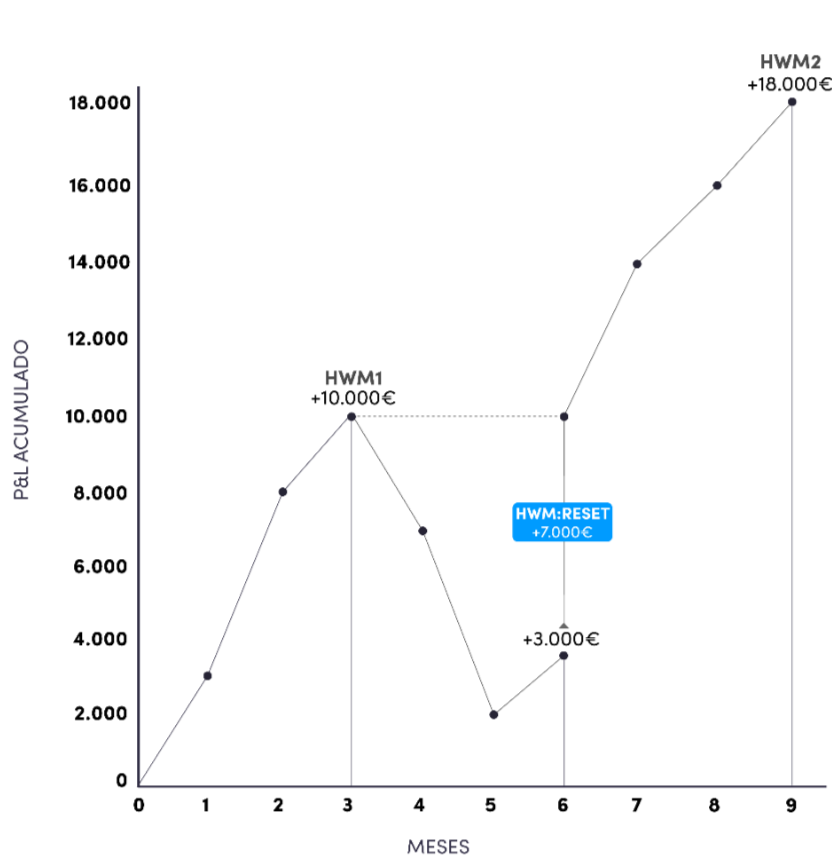

Let's suppose there are 3 non-simultaneous allocations: 1 allocation from month 0 to month 3, another allocation from month 3 to month 6, and a third from month 6 to month 9.

For DarwinIA allocations, the performance fees and HWM would have worked as follows:

1) Quarter 1: You have obtained 10.000€ in profits, hence HWM1 is 10.000€ (15% performance fees = 1.500€ performance fees received)

2) Quarter 2: You have lost 7.000€, no additional performance fees received.

3) Quarter 3: You get 8.000€ in profits. In normal situations, this would mean 1.000€ in additional profits (-7.000€ to recover from Quarter 2) from HWM1 (and 150€ in performance fees as a consequence). However, for DarwinIA allocations, losses from quarter 2 are reset to HWM1, so the new HWM2 is +18.000€, and you'd get performance fees for the 8.000€ profits obtained in this quarter (1.200€).

2. The time period (a quarter)

Performance fees are charged per DARWIN on a quarterly basis, i.e. every three months. The quarter starts when the first allocation has been received in the DARWIN. Successive allocations have no effect on the starting date of the quarter, as this is set uniquely based on the first allocation date.

Each time the quarter ends, if the previous high-water mark has been surpassed, 15% of the net profit (closed profit + open profit) generated in the quarter will be paid to the trader.

Performance Fee & Investor Behaviour section