Currency impact

Results in an investment in a DARWIN may differ from the DARWIN's return

There are some factors that creates differences in the DARWIN's return and investor's return in the DARWIN.

Differences in base currency

When the investor's Wallet currency differs from the DARWIN's base currency, there can be small differences in the value of trades, due to the value of both currencies whilst the trade remains open.

Their long term evolution is random, therefore trades can have both positive and negative divergence due to base currency.

Learn how divergence due to base currency may affect your investments in DARWINs.

Lets say you are an investor and your Wallet is denominated in euros (EUR).

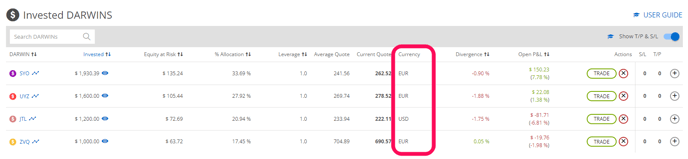

However, when you check your portfolio of DARWINs you may notice that some of them may have a different base currency than the one reflected in your Wallet.

Could this affect you? The answer is YES.

How exactly it affects you is the topic of this article.

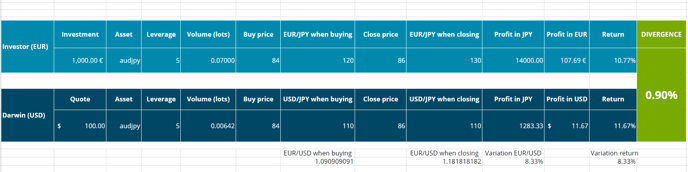

Put yourself in the situation of having invested 1000 euros in a DARWIN denominated in US dollars which is about to make its first trade.

Its quote reflects 100 as with every new DARWIN.

The first trade this DARWIN will replicate is a trade in the USDJPY with a 1:5 leverage.

In order for you (EUR) to achieve the same leverage as the DARWIN (USD), you'd have to buy a slightly larger volume of the asset as the DARWIN trading in USD and, as we write this article, the EURUSD quotes at around 1.20.

Although you buy and sell the asset (USDJPY) at the same price, while the trade remains open, the value of the EUR against the JPY will vary, whereas the value of the USD against the JPY will remain constant.

This means that even if the trade was open and closed at the same time for both the DARWIN and yourself (same amount of pips), the pip value will depend on the evolution of the EURUSD while the trade remains open.

Spread and commissions on purchases on DARWINs with trades open

Whenever a purchase is made in a DARWIN that has open trades, the investor would be incurring in the execution fee and spread on the underlying trades opened by the DARWIN. This would be added to the currency impact and it is the reason why there would be a initial small negative currency impact on an investment made in a DARWIN with open trades.

Other factors that may affect currency impact

There are other reasons for discrepancies, including rounding effects or market execution problems.

Purchases on DARWINs with underlying trades whose market is closed.

If a DARWIN is purchased and has an open trade in an underlying asset whose market is out of trading hours, those trades would be queued and there may be discrepancies meanwhile.

It may also happen that a DARWIN provider opens a trade very close to the market closure and the replica cannot be executed for the DARWIN's investors until the next market opening, generating a discrepancy that would be fixed when the trade is executed by the investors.

Let's sum up these takeaways

- When replicating all the DARWINs' trades, and even if you have invested in a DARWIN with a different base currency, you will always trade in the currency of your Wallet.

- Base currency divergence only affects profits. If the DARWIN makes a winning trade, your replication of the trade cannot become a losing trade due to base currency divergence.

- The only variation that counts is the one occurring while the trade is open. Any variation before or after the trade has absolutely no effect on divergence due to base currency.

- When all trades of a DARWIN have a similar duration, divergence due to base currency will be random: sometimes it will benefit you and others not.

- When the duration of the trades is very long (weeks or months), divergence due to base currency can be higher than usual.

- Purchases on DARWINs with open trades would incurr in an initial slight negative currency impact.

- There may be temporary discrepancies due to market execution conditions when a DARWIN's trade cannot be replicated for investors at the same time.