How to select DARWINs for investing

Main aspects to take into account for creating a portfolio made of Darwins

Investing in DARWINs is not available for Darwinex Global (FSA regulated) clients.

We know creating your first investment portfolio at Darwinex may not be an easy task, so here you have some tips and main recommendations to keep in mind:

1. Diversify. The ideal portfolio should be composed by several Darwins, keeping a similar relative weight of each one of them in the portfolio. An optimal number of Darwins would be between 4 and 8.

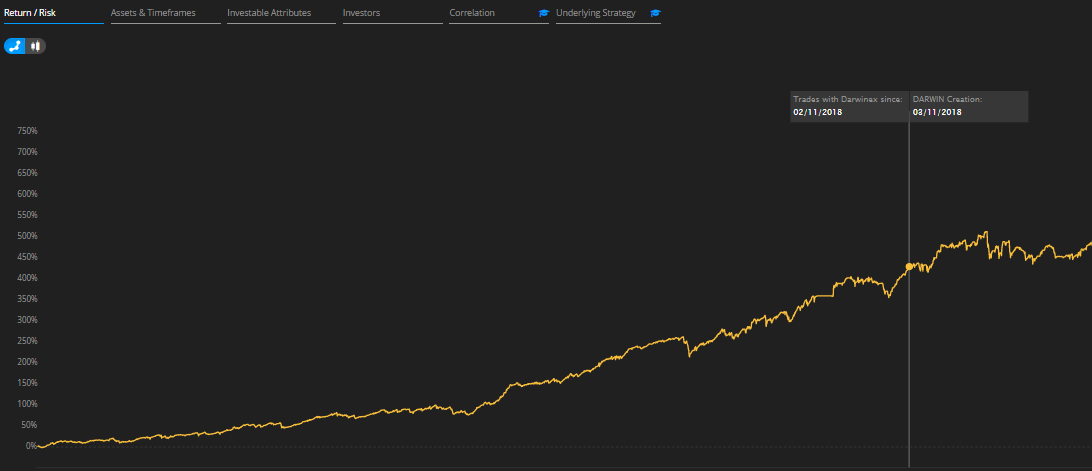

2. Pick Darwins that have several years of track-record, and several months of Darwinex trading history (the total Darwinex track-record may not match Darwinex trading history if it's a Darwin migrated from another broker). You can identify these migrated Darwins when the "Trades with Darwinex since..." date is shown on the graph:

3. Look at Darwin's risk management, measured by the attributes Risk Stability (Rs) and Loss Aversion (La). The "Rs" attribute measures the stability of the risk assumed in positions that compose a trading strategy, while "La" attribute evaluates whether a trading strategy exhibits symmetrical behavior in winning and losing positions. A combination of bad scores in both attributes could be an indicator of strategies that may incur in deep drawdowns in a short period of time.

4. Select Darwins with a good D-score. The D-Score analyzes the quote of the Darwin for the last 5 years to determine it's ability to generate future returns.

In addition to these main factors, there are other factors recommended to follow for creating and monitoring a Darwin portfolio.

- Keep track of the Darwins that make up the portfolio with some regularity. Make changes if you notice a change in a Darwin's performance, or if it no longer meets the core recommendation criteria.

- Rebalance the portfolio periodically, so that each Darwin maintains the appropriate weight in the portfolio.

- A big historic drawdown does not necessarily be negative. If the Darwin has recovered and still get positive returns, it may be an indicator the strategy has been able to recover from adverse environments.

- Diversify between different types of DARWIN (assets traded, duration of positions, etc.).

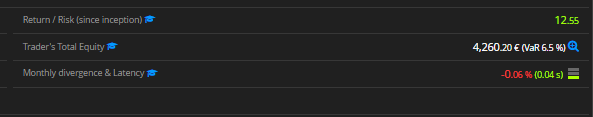

- Pay attention to the trader's total equity of the Darwin. This may be an indicator of how much risk the trader takes into his own strategy, and the level of confidence he has in it. You can check this information on the main page of any Darwin:

- Analyze the correlation between DARWINs so that is not too high.

To pick the Darwins you want to invest in, Darwinex offers different search tools based on the use of filters.

Some of these filters are predefined, while others you can easily configure yourself by creating your own customized filters.

Tips

Finally, don't forget you can always open a Demo investment portfolio before start investing with real funds. Keep in mind the minimum investment in a Darwin is 200 EUR/ USD/ GBP, so you can start investing with a small amount and increase the investment later on.

In addition, we recommend that you save the Darwins you like in your "Favorites" list, so that you'll be able to follow up if at any time you want to make changes in the portfolio.

Don't forget the most important factor is not to take more risk than you can afford, so always invest with caution, and bearing in mind that past results do not guarantee future returns.