D-Period

At Darwinex we have developed our own tool to measure the Experience (Ex) of live trading accounts: the D-Period.

Introduction: Experience (Ex) & D-Period

Valuing the accumulated experience of a trading strategy is fundamental for gauging the statistical value the results give us.

The greater the Experience (Ex) accumulated by a strategy, the greater its statistical importance, and the more reliable the conclusions that can be extracted from its analysis.

Nevertheless, anyone who wants to measure the experience of trading strategies will come up against the following difficulties:

- What unit of measurement should be used?

- Is it possible to compare the experience of two strategies that are very different?

At Darwinex we believe there is no better way to measure experience than through the market exposure of all its positions.

Such exposure is calculated using the variables

- D-Leverage

- Time.

How can I accrue 1 D-Period of Experience?

In order to accumulate 1 D-Period of Experience (Ex) you have to fulfill two conditions:

- Trade for a minimum of 15 trading days.

- Accumulate 18 representative trading decisions.

In order to calculate the representative trading decisions, we follow the steps below:

1. Exposure per position

We calculate the market exposure of each position open in the last 15 trading days using the following formula:

Exposure = D-Leverage* x √Time

*The D-Leverage is Darwinex's own tool which standardizes the risk of all positions using the EURUSD as a reference.

To calculate the D-Leverage, we take into account both the nominal leverage and the underlying volatility of all the trades opened simultaneously, and we compare it with an unleveraged trade on the EURUSD.

2. Reference: position with the biggest exposure

Of all the positions opened in the last 15 trading days, we take the one with the biggest market exposure and use this as a reference with the rest.

This position will have a value of 1 representative trading decision.

3. Calculate the exposure of the rest of the positions

To do this, we divide the exposure of each decision by the exposure of the most representative trading decision.

This means that the exposure and the representativeness of the rest of the positions will be a fraction of the position which we have taken as a reference in point nº2.

4. We add up everything

We add up the aggregated exposure of all the positions opened in the last 15 days of trading and the result will be the number of representative trading decisions which we have accumulated.

Remember that to obtain a D-Period of experience you must have:

- 18 representative trading decisions

- Minimum period of 15 trading days.

The Experience (Ex) Investable Attribute score is the only one we cannot decrease - except in very exceptional cases and only temporally -, and the maximum experience that can be accumulated is equivalent to a score of 10, which is 12 D-Periods.

A score of 1 in the Experience (Ex) Attribute is equivalent to 1.2 D-Periods.

Case Study

We will look at a practical example that will help to better understand the influence of representative trading decisions on the calculation of the Experience (Ex) score.

Imagine two trading systems:

- System A => intraday trading strategy

- System B => swing trading strategy

System A leaves its positions open for less time than system B, but uses more leverage.

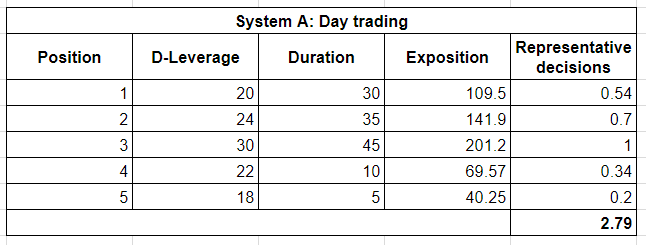

System A: Interday

1.- D-Leverage = 20 Duration = 30 minutes

2.- D-Leverage = 24 Duration = 35 minutes

3.- D-Leverage = 30 Duration = 45 minutes

4.- D-Leverage = 22 Duration = 10 minutes

5.- D-Leverage = 18 Duration = 5 minutes

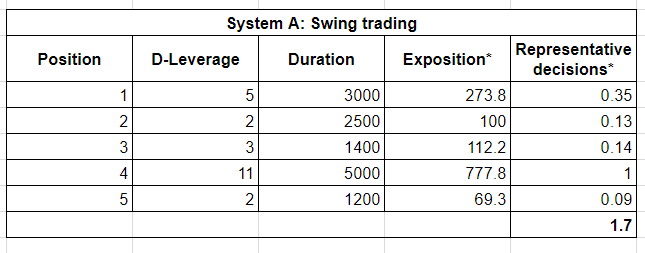

System B: Swing Trading

1.- D-Leverage = 5 Duration = 3000 minutes

2.- D-Leverage = 2 Duration = 2500 minutes

3.- D-Leverage = 3 Duration = 1400 minutes

4.- D-Leverage = 11 Duration = 5000 minutes

5.- D-Leverage = 2 Duration = 1200 minutes

Which of the two systems do you think has accumulated more representative trading decisions - Experience (Ex)?

* Exposition = D-Leverage* x √Time

* Representative decisions = We divide each one of the exposure by the largest to obtain their respective fractions. In this case, the largest one is 201.2, which is now equivalent to one representative decision. The rest are fractions of the representative decisions.

Notice how System B: Swing trading has been penalized by the fact that its positions did not have homogeneous D-Leverages and durations.

In this example, position 4 is the one that acts as the reference with an exposure of 777.8 and obtains 1 representative trading decision.

Nevertheless, by having a market exposure much higher than the other positions, these positions are overshadowed by the size of the most representative decisions, and the impact on the overall exposure will be reduced.

On the other hand, System A accrued more Experience (Ex) since its positions in terms of D-Leverage and duration were more homogeneous.

As a result, System A. Day Trading will have accumulated more representative trading decisions (2.79), than System A: swing trading (1.7).

Tips

1. D-Periods add to Experience (Ex)

Experience (Ex) is the only attribute out of the 12 that Darwinex offers that always goes up!

2. Homogeneity is important

As seen in the example above, homogeneity between the D-Leverage / Duration is fundamental to build up experience the fastest way possible.

3. Maximum 12 D-Periods

It is not possible to accumulate more than 12 D-Periods of Experience (Ex). When you reach the point the score in the Experience Attribute will be 10.

4. Limit of 12 D-Periods for calculating scores in the Investable Attributes

Investable Attribute scores only take into account the 12 last D-Periods of Experience, with the exception of the Loss Aversion (La),and Positive / Negative return and duration consistency (R+ / R- / Dc) Investable Attributes which are calculated with the last 3 D-Periods.