Futures margin requirements

In this article, we take a closer look at what futures margin is all about and how it affects your trading capabilities.

Futures Margin, what is it?

When entering into a futures contract, it is not necessary to provide the full face value of the contract, but a portion of it which is called margin.

Initial margin vs. maintenance margin

There are two types of margin in futures contracts:

- Initial margin is the minimum amount set by a futures exchange platform to enter a futures position.

- Maintenance margin refers to the amount that you must maintain at any given time in your trading account to cover potential losses on your positions. The maintenance margin amount will be lower than the initial margin.

Unlike CFDs, futures contracts do not charge/pay swaps

Futures Margin at Interactive Broker

At Interactive Brokers the required margins are specific to each contract and change daily.

In addition, a distinction is made between margins for an intraday operation -intraday- and for an operation of more than one day -overnight-.

Therefore, in IBKR you have 4 types of margins:

- Intraday Initial Margin

Minimum amount to open a futures contract

- Intraday Maintenance Margin

Margin required by the broker to keep the position open

- Overnight Initial Margin

Margin required by the broker 15 minutes before market close

- Overnight Maintenance Margin

Margin required by the broker while the market remains closed

Keep in mind that the required margins will be equal to or greater than those required by the Exchange and are unique for each contract, regardless of its expiration.

IMPORTANT: the margins published on our website are indicative and those that prevail are those shown on the client portal & TWS terminals.

Check the margin on both the Client Portal and TWS terminal

TWS Terminal

To check the margin of a particular future in TWS you have to follow these steps:

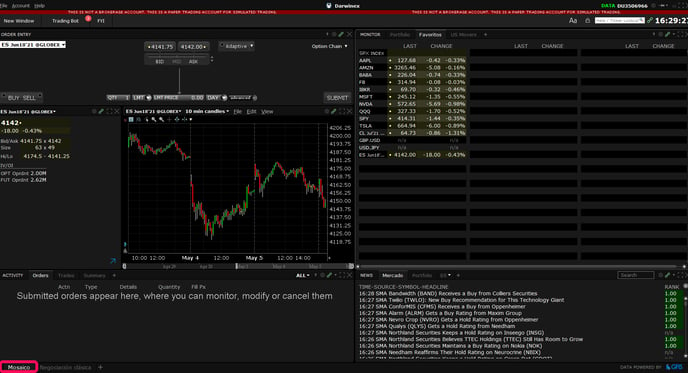

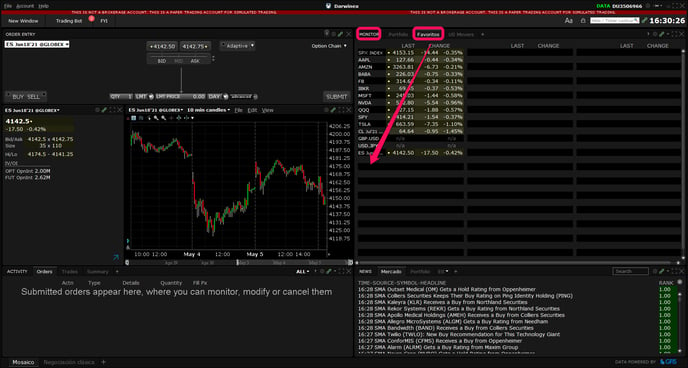

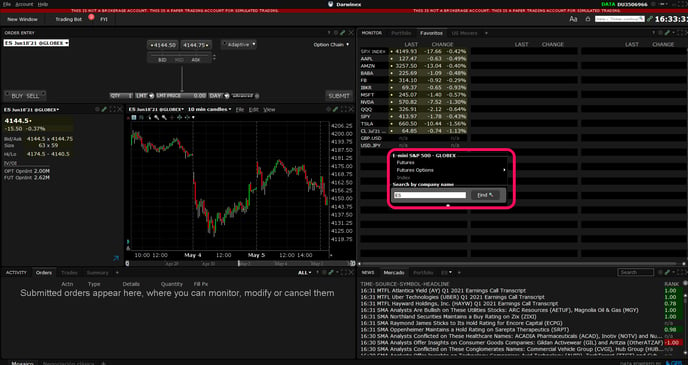

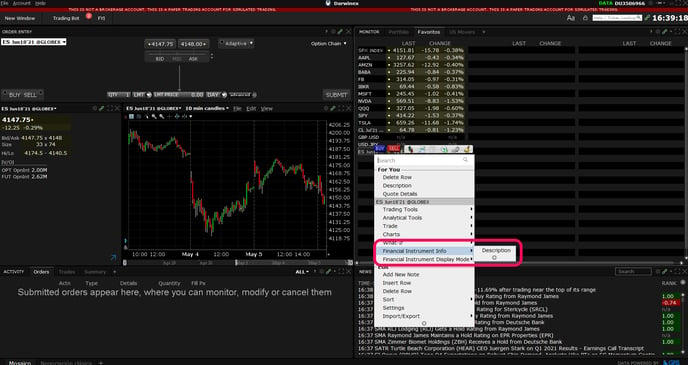

- Select the "Mosaic" option at the bottom left of TWS

- In the "Monitor" section, "Favorites" tab, type in the ticker name of the future contract

- Press "enter" and select the future you want to trade

- Hover the mouse over it and right-click.

- Select the option "Financial Instrument Info" / "Description" and consult the contract specifications

Client Portal

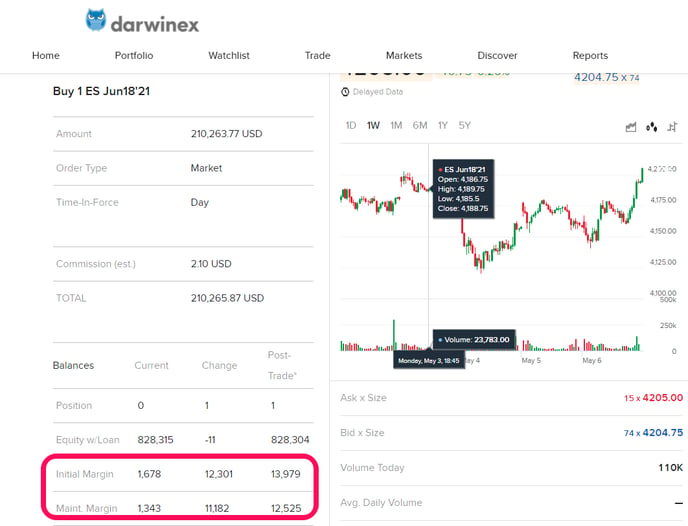

To be able to check the margin of a specific future in the Client Portal, you have to follow these steps:

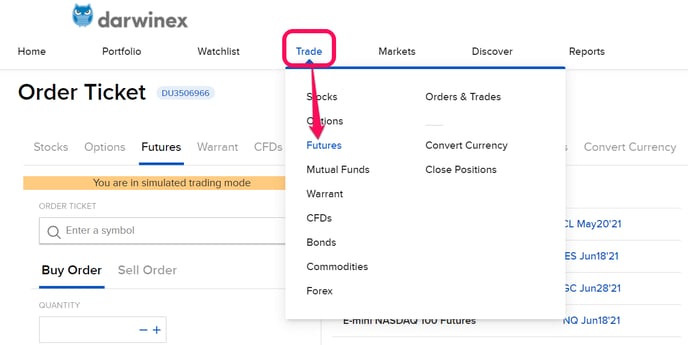

- Click on "Trade" / "Futures"

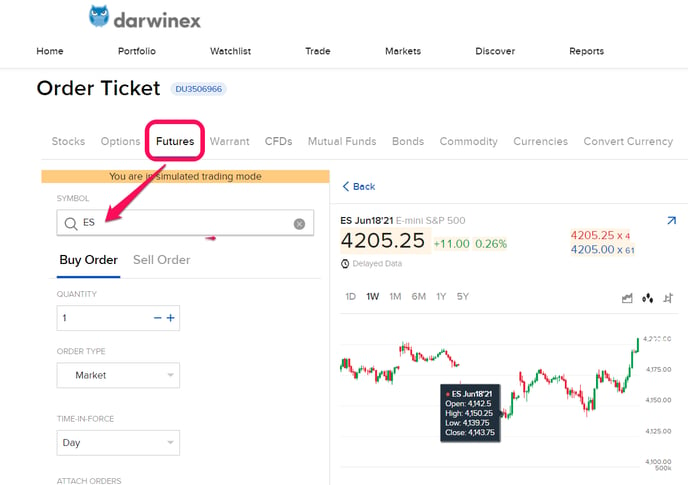

- Select the asset you want to trade

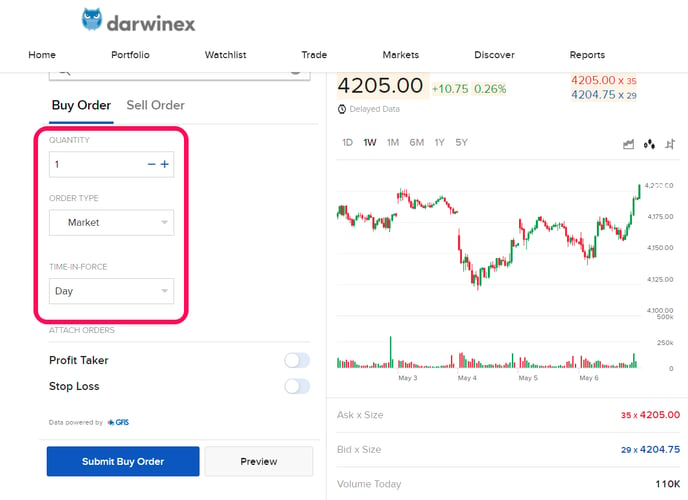

- Enter the quantity, order type, and time-in-force

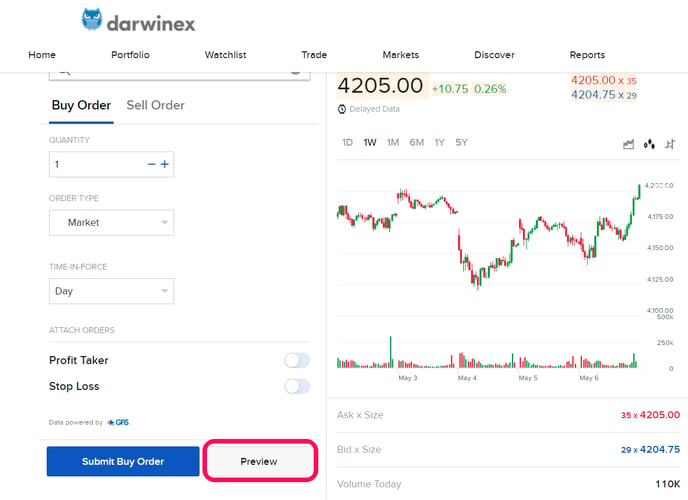

- Click on the "Preview" button

- Check both the initial and maintenance margins

Margin calculation

Futures margin requirements are based on risk-based algorithms.

All margin requirements are expressed in the currency of the traded product and can change frequently.

Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon.

A price scanning range is defined for each product by the respective clearing house.

Margin requirements for futures are set by each exchange.

Stop-Outs

As with a CFD trade, stop-outs are executed when the equity reaches the margin.

The only peculiarity with a futures contract, when compared with CFDs, is due to the existence of different margins.

As we have previously described, once the position is opened in a futures contract, it is required to keep a maintenance margin, which will be different depending on whether it is intraday or overnight.

- The intraday maintenance margin is checked in real-time, in such a way that if your equity reaches the margin, an exit trade will be triggered

- The overnight maintenance margin is checked 15 minutes before the market closes and if your equity reaches the margin, an exit trade will be triggered.

In the event that there are several open positions, the system has an internal algorithm that will first sell those positions that reduce the highest possible margin with the lowest cost in relative terms.