Performance fees

Darwinex charges a 20% performance fee on any 3rd party profit in DARWINs (15% is for the DARWIN provider and 5% for Darwinex) using the HWM (high-water mark) method.

How is it calculated?

The calculation depends on two elements.

1. The high-water mark

The high-water mark, or HWM, is a widely used concept in the assets management industry as a reference for the fees that managers should receive.

Using this method we ensure that they only receive fees for the profits they have actually generated and that this does not overlap with profits from previous time periods.

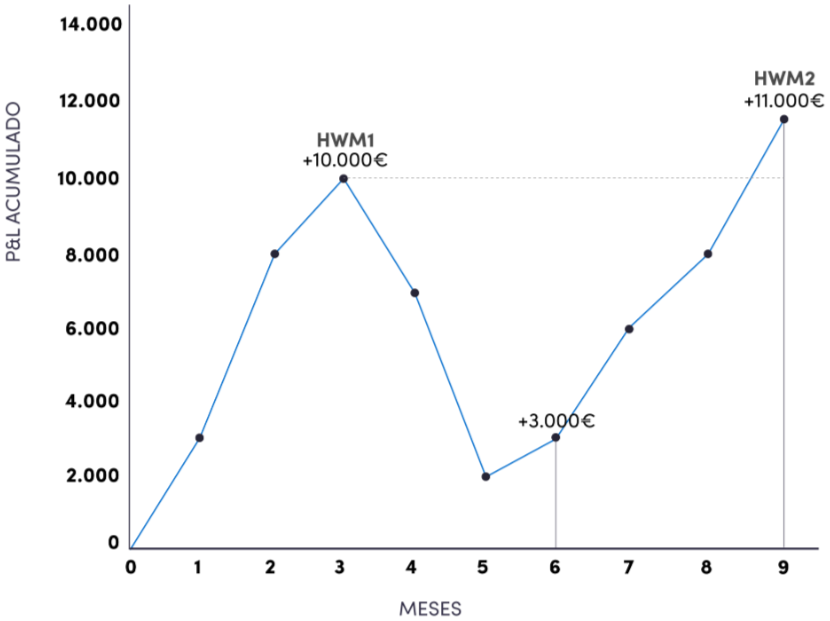

Let's look at an example of a graph showing the progress of a DARWIN's quote. For the sake of the example, let's imagine that the investor has remained invested for the whole 4 quarters*.

*Remember that the high-water mark is calculated based on the net profits generated by investors since their very first investment in a DARWIN, and not based on the DARWIN's quote.

In the graph, we can see how the HWM is calculated as the months go by.

In the third month, the HWM1 is calculated for the profit generated in this quarter. In this case, $10,000 of profit would have been made.

In the following quarter, no new HWM would be generated, since €7,000 would have been lost in this quarter and the start-up profit would have been reduced to €3,000. However, at the end of the third quarter, HWM1 is exceeded again by €1,000, so a new high water mark is established: HWM2. Performance fees would thus be paid for the difference between HWM2 (€11,000) and HWM1 (€10,000), i.e. €1,000 in additional profit.

2. The time period (a quarter)

At Darwinex performance fee is charged per DARWIN and per investor on a quarterly basis, i.e. every three months. The quarter starts when the first investment by an investor is made in the DARWIN. Successive investments by the same investor in the same DARWINs have no effect on the starting date of the quarter.

Each time the quarter ends, if the previous high-water mark has been surpassed, 20% of the net profit (closed profit + open profit) generated in the quarter will be charged to the investor, which 15% corresponds to the trader and 5% to Darwinex.

Where can I see this?

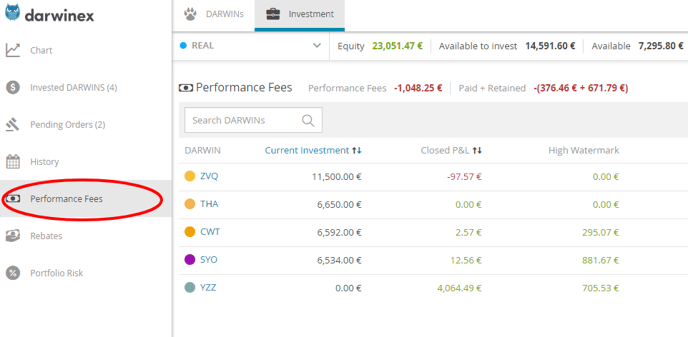

In the "Investment" section, the subsection named ''Performace fees'' displays all historical performance fees you have paid for your investments, as well as retained performance fees for investments sold during the current quarter.

Selling an investment before the end of the quarter

If you sell an investment before quarter-end, performance fees get retained. They'll be charged only at the end of the quarter and only if they still apply.

It may happen that you sell an investment with profit and have performance fees retained. However, if you decide to invest again in the same DARWIN and end up closing your investment quarter with losses, retained performance fees would be paid back to you.